The global vinyl flooring market was valued at USD 25.6 billion in 2018 and is projected to grow at a CAGR of 7.4% from 2019 to 2025. The increasing demand for low-maintenance, cost-efficient, and lightweight construction materials in residential buildings is expected to drive the market for vinyl flooring during the forecast period.

Vinyl flooring increase in demand and diversification of channels

The vinyl flooring penetration rate is rapidly increasing and is a significant alternative to traditional flooring materials.

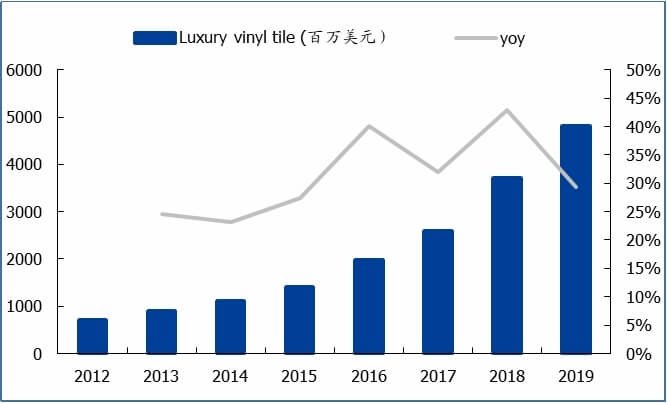

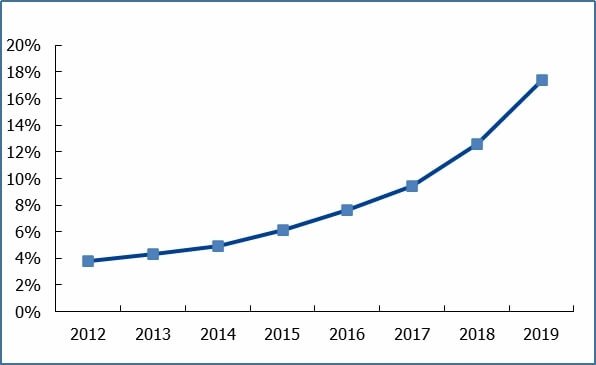

According to FCW statistics, LVT flooring sales in the U.S. grew from $718 million in 2012 to $4.804 billion in 2019, with a CAGR of 31.2% and a penetration rate of 17.4% from 3.77%.

Within the flooring category, vinyl flooring is replacing low-grade traditional flooring materials with its realistic appearance, quick installation and maintenance, excellent water resistance and durability, and reliable environmental friendliness. The higher cost performance within the vinyl flooring category makes SPC a partial replacement for WPC.

The U.S. flooring materials market size in 2019 was $27.6 billion, and LVT flooring accounted for 17.4%.

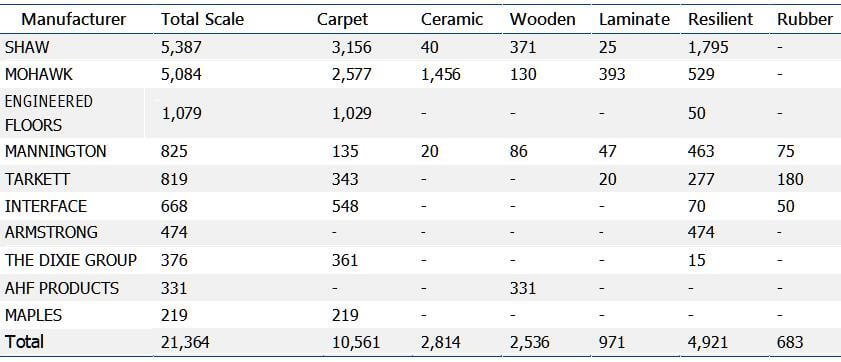

The U.S. flooring materials market concentrates more on brand names and is fragmented into channel players. According to Floor Focus, SHAW, and MOHAWK accounted for 25.2% and 23.8% of the market share, respectively.

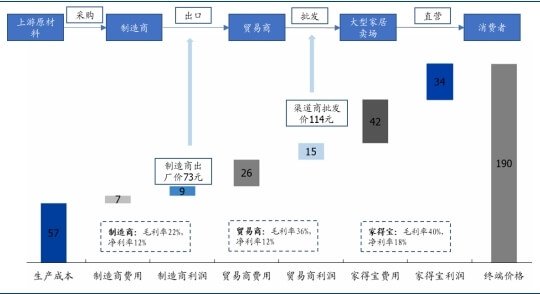

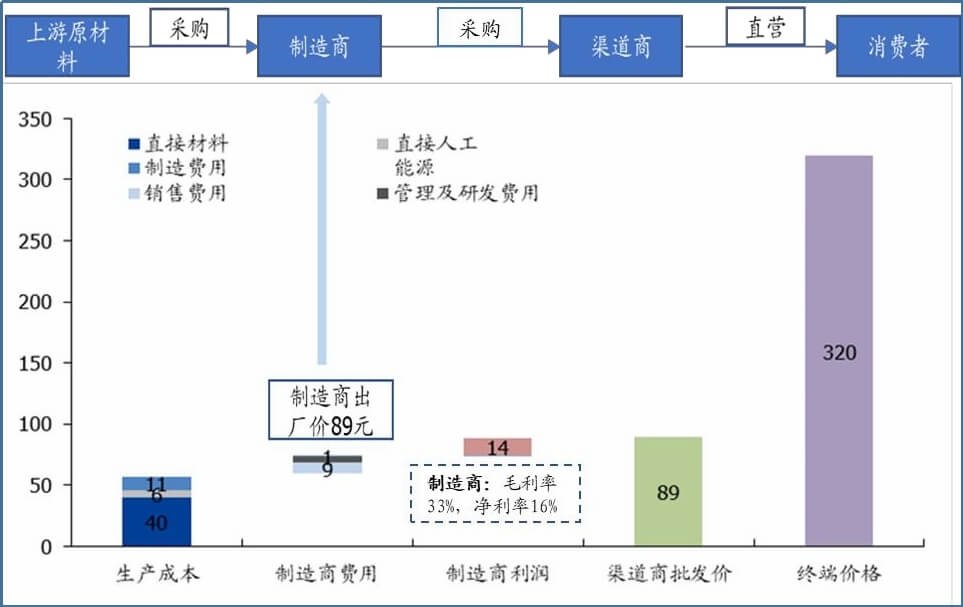

Most major brands use the outsourcing model to consolidate product supply. From brand to distributor to retailer, there is a multi-brand and multi-category operation, with distributors usually selling branded products or sourcing suppliers globally and operating under their brands. Specifically, in the end sales chain, flooring decoration independent stores accounted for 45%, chain building materials, and home furnishing stores accounted for 15.6%, and 8.2% for specialty hard surface finish stores.

According to FCW’s survey, a single retailer displays products from 8-10 resilient flooring (SPC) manufacturers/brand names in their stores. The huge market demand and decentralized and diversified sales channels provide vast business opportunities for importers.

According to FCW’s statistics, the share of imports in total U.S. resilient flooring sales (by area) reached 82.7% in 2019, up from 71.6% in 2017, with higher import penetration in LVT flooring.

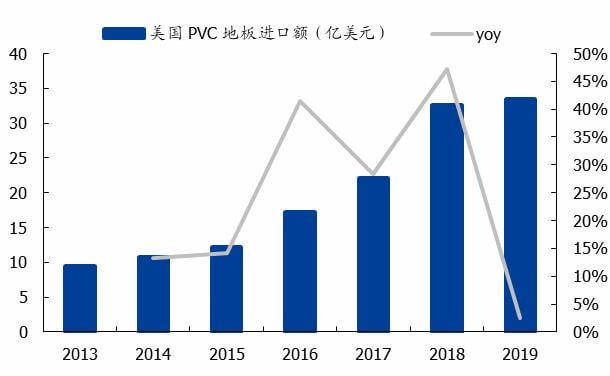

In recent years, U.S. resilient flooring imports have increased yearly, with a compound growth rate of 28.15% from 2013-2018, reaching $3.345 billion in 2019. The SPC and WPC production capacity distribution, mainly concentrated in mainland China, Southeast Asia, South Korea, and other Asian countries and regions, has some production capacity.

Exchange rate + shipping capacity + raw material prices phase disturbance, import enterprises short-term cost pressure.

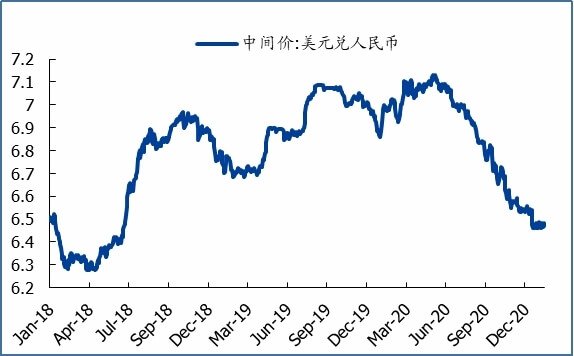

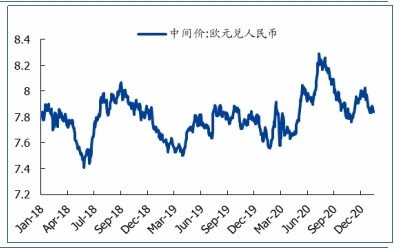

(1) Due to the rapid recovery from the Chinese epidemic and the uncertainty of the general environment overseas, the continued strength of the RMB is expected to affect the import-oriented vinyl flooring manufacturing companies in terms of revenue, gross margin, and financial expenses. Still, the impact is expected to disappear as the epidemic gradually normalizes.

2) Due to the impact of the return turnaround of sea containers after the import has become slower, resulting in a significant increase in sea freight costs, vinyl flooring imports mainly adopt FOB quotation, with downstream customers bearing the freight costs. Most downstream customers have transferred pressure behavior to the terminal price increase, so it is judged that sea freight has little impact on vinyl flooring import companies.

3) At the same time, vinyl flooring prices have now gradually fallen, despite the cost pressure in 2020. Still, customers and manufacturers generally share the pressure of raw material price increases. It is expected that the impact of raw material price increases in the future is expected to recede gradually.

Advice: The United States luxury vinyl flooring industry’s 2012-2019 compound growth rate of 31.2%, the market size of $4.8 billion in 2019, and the market demand is booming.

U.S. resilient flooring demand import dependence is severe. Imports account for more than 80% of the continued increase in penetration, expansion of the market space, and decentralized and diverse sales systems for import enterprises provide a wide range of business opportunities.

Exchange rate fluctuations, raw material price fluctuations, shipping capacity supply shortages, and other short-term disturbances do not change the industry demand boom.

The core recommendation of SPC flooring export manufacturers is SUNTONE FLOORING.

1. How to understand the North American market vinyl flooring penetration rate increase?

1.1 Vinyl flooring is the fastest-growing floor covering material in the North American market

According to the information from the American Resilient Flooring Institute (RFCI), the development of resilient floor coverings has a relatively long history. Rubber, cork, linoleum, asphalt, and other resilient ground decorations appeared earlier than vinyl ground decorations until the 20th century.

In the 1960s, cushioned vinyl flooring and “wax-free” resilient flooring was introduced for greater underfoot comfort and ease of maintenance. In the 1980s, luxury vinyl (LVT) emerged as a flooring material. Over the past few decades, resilient flooring performance has been optimized to The performance of resilient flooring has been optimized over the last few decades meet the needs of the market.

Since 2012, wood-plastic composite flooring has been introduced to the market. Resilient flooring has started a rapid development path with high penetration.

In 2016, stone-plastic flooring was introduced into the market. Its higher impact resistance and lower price quickly replaced traditional flooring materials. It became the fastest-growing flooring material in the past few years.

Resilient floor coverings can be divided into ordinary vinyl floor coverings, luxury vinyl flooring, and other resilient floor coverings. Ordinary vinyl floor coverings mainly include rolls and sheets with a low unit price; other resilient floor coverings include linoleum, cork, rubber, asphalt, and other materials; luxury vinyl flooring is the fastest growing category in recent years, including flexible LVT and rigid core LVT, of which rigid core LVT mainly refers to stone plastic composite flooring (SPC) and masonry LVT.

The rigid core LVT mainly refers to wood-plastic composite flooring (WPC) and stone-plastic composite flooring (SPC). According to Floor Covering Weekly, the market size of LVT products (including WPC and SPC) in the U.S. market reached $48 billion in 2021, accounting for 17.4% of the total floor covering market size.

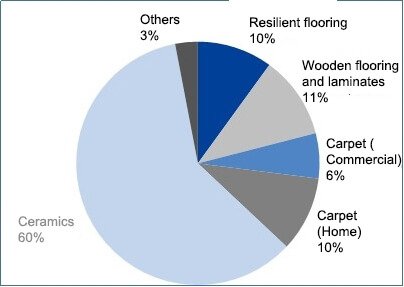

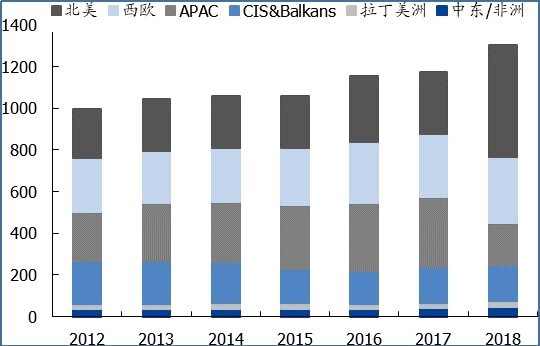

The North American market is the largest and fastest-growing region in the world for resilient flooring demand. According to Tarkett 2019 Registration Document, resilient flooring accounted for 10% of the global floor coverings market in 2018, up one percentage point from 2017. The region that mainly drives the global resilient flooring scale and share of the increase in North America, with resilient flooring sales scale of 537 million square feet in North America in 2018, with a compound growth rate of 15% from 2012-2018.

Demand for LVT flooring in the U.S. is growing at a CAGR of more than 30%. LVT flooring (including LVT, WPC, SPC, etc.) sales in the U.S.

The U.S. sales of LVT flooring (including LVT, WPC, SPC, etc.) will grow from $718 million in 2012 to $4.804 billion in 2019, at a CAGR of 31.2%.

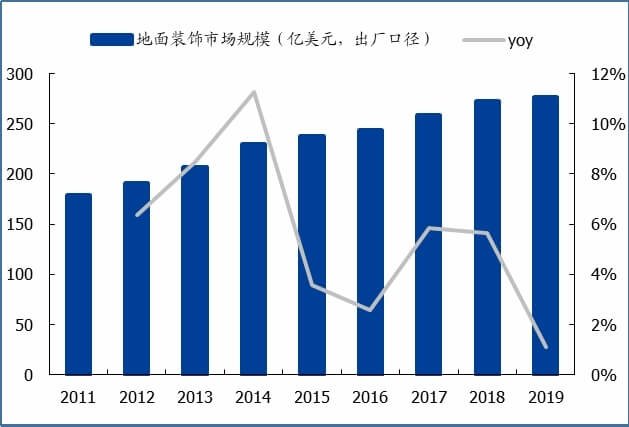

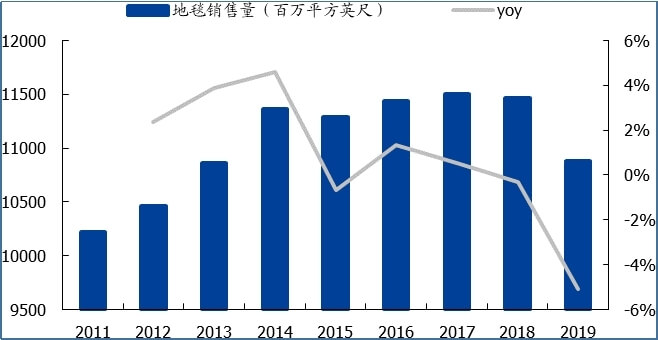

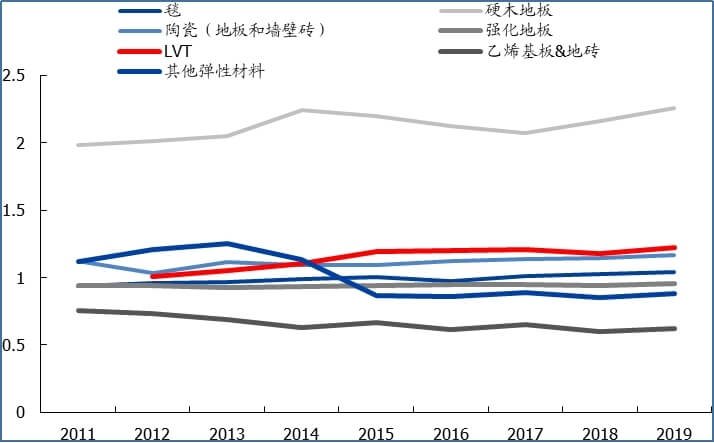

LVT flooring growth is faster than the growth of the U.S. floor covering market, with a significant substitution for traditional floor covering materials. U.S. floor coverings are growing steadily, with the overall size of the U.S. floor coverings markets at $27.6 billion in 2019, up 1.1% year-on-year. 2011-2019 U.S. floor coverings compound growth rate of 5.6%.

1.2. LVT flooring is a significant alternative to traditional floor coverings

LVT products’ rapid penetration is mainly due to their realistic appearance and diverse design, fast and easy installation and maintenance, excellent waterproof performance, hardness, durability, and higher-cost performance. LVT flooring alternative is mainly for carpet products, solid wood flooring, and other resilient floor coverings.

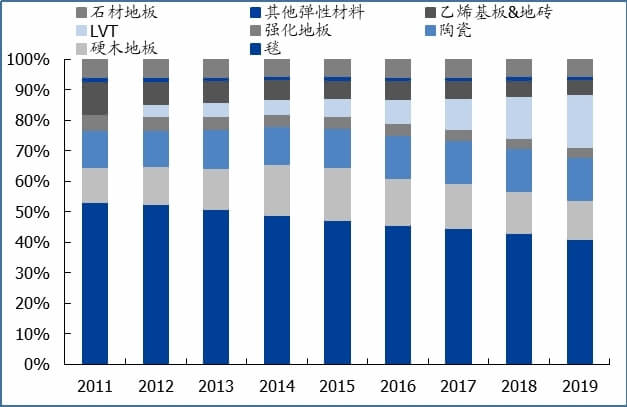

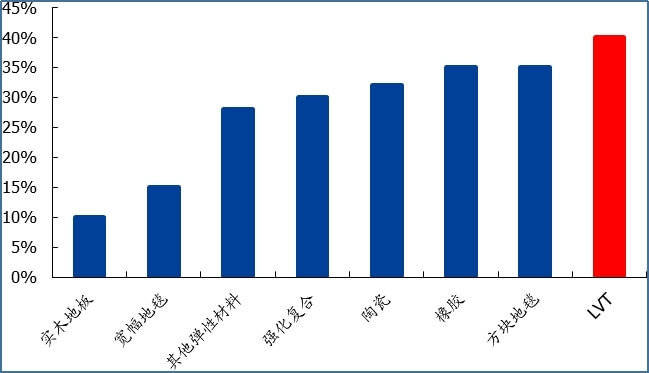

Floor covering materials mainly include carpet, LVT, ceramic tile, hardwood, stone, vinyl plank & floor tile, laminate flooring, other resilient materials, etc., corresponding to 2019 U.S. market penetration of 41%, 17.4%, 14.1%, 13%, 5.5%, 4.8%, 3.3%, and 1.0% respectively.

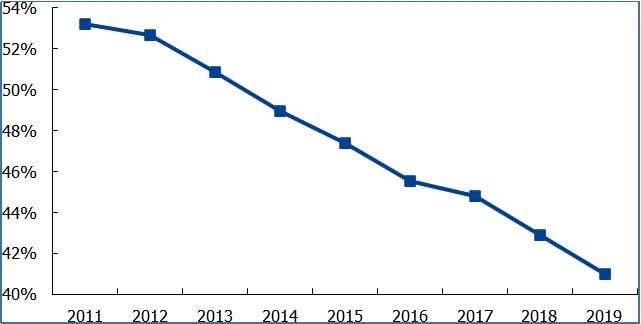

Carpet penetration rate from 53.21% in 2011 down to 40.97% in 2019; laminate flooring penetration rate from 4.99% in 2011 to 3.25% in 2019; solid wood flooring penetration rate from the peak of 17.18% in 2015 to 12.95% in 2019; ceramic tile, stone penetration rate remained stable; vinyl plank The penetration rate of LVT & tile declined from 10.82% in 2015 to 4.78% in 2019.

LVT Flooring mainly achieved the replacement of low-end wood panel products, carpet, laminate flooring, and other low-end resilient flooring materials.

The replacement of wood flooring is mainly concentrated in the low-end product line: Due to the increase in the price of wood, tariff increases lead to a rise in the unit price of the product. In addition, the product itself does not have waterproof performance, and wear resistance is not as good as the rigid core of WPC and SPC flooring, resulting in a higher cost performance of WPC and SPC to solid wood flooring substitution is significant. In terms of sales, wood flooring sales have declined since 2018, down 3.26% and 9.59% year-on-year in 2018-2019; in terms of the selling price, the average price of wood flooring increased by 3.97% and 4.67%, respectively in 2018-2019.

The gross margin of LVT products is significantly higher than that of traditional materials such as solid wood flooring. Regarding product profitability, the gross margin level of LVT products is above 40%. In comparison, the gross margin level of ordinary solid wood flooring is only about 10%. The gross margin level of ceramic, rubber, laminate, square carpet, etc., is between 30%-35%. The high profitability of LVT products drives brand owners, distributors, retailers, etc., to promote new products. At the same time, wood flooring has been compressed repeatedly due to factors such as price increases, and sales volume and penetration rate continue to decline. The sales and penetration rates continue to decline.

Limited substitution for ceramic products:

The penetration rate of ceramic tiles was 14.1% in 2019, an increase of 0.7% year-on-year. It was the only product with no decline in sales in 2019.

The main performance advantage of SPC flooring sales is water resistance, which is not as good as ceramic products.

Vinyl flooring’s waterproof performance, durability, and ease of cleaning to replace carpet: the penetration of carpets in the U.S. market from 53% in 2011 to 40.97% in 2019.

1) Compared with carpets, vinyl flooring has a longer service life.

The service life of SPC flooring can reach more than five times the service life of traditional carpet;

2) The cleaning of vinyl flooring is easier and lower maintenance costs;

3) the flame retardancy and water resistance of vinyl flooring are more advantageous.

4) In the traditional carpet design and quiet and other advantages, vinyl flooring with the help of digital printing technology can achieve a variety of patterns, and consumers have more choices. In addition, SPC flooring can also increase sound-absorbing materials. The same can have the effect of sound absorption and noise reduction. COVID-19 accelerates the development trend of a clean home, and carpet materials easily hide dirt. In contrast, vinyl flooring materials are easy to clean. Further, accelerate the trend of resilient flooring materials to replace traditional carpets.

Environmental protection has achieved the replacement of laminate flooring:

In March 2015, a major U.S. flooring retailer, Lumber Liquidators, was found to have sold laminate flooring with excessive formaldehyde emissions, leading to a class action lawsuit against Lumber Liquidators by 760,000 consumers. According to FCW, laminate flooring has a low penetration rate in the U.S. market. Due to its environmental quality issues, sales, and penetration continue to decline, from a 5% penetration rate in 2011 to 3.25% in 2019 gradually, with laminate flooring sales decreasing by 6.2% in 2019.

Significant substitution for other low-end resilient materials:

Ordinary vinyl rolls are lower in unit price, thinner in thickness, mainly in sheets, and primarily use glue substrates in the construction process. On the other hand, SPC products are thicker, stiffer, and easier to install, becoming more widely used in commercial and residential markets. According to FCW, the 2019 general vinyl roll/sheet declined by 9.84%. In terms of other resilient materials (including asphalt, cork, rubber, etc.), sales declined 7.84% in 2019.

| General Vinyl Flooring | SPC | |

| Cost | $0.50-$2/ft | $2-$9/ft |

| Thickness | Very thin | Thicker, harder |

| Size | 6/12 ft. rolls or 6-18 sq. in. sheets | 42*48 in. sheets or 12-18 sq. in. sheets |

| Installation Method | Glue base | Click-Lock |

| Durability | 10-15 years | Up to 30 years |

| Product Rating | Saw as the “bargain” in flooring | More valuable product |

SPC flooring offers a good value for money in terms of the price band of products. LVT products are significantly less expensive than stone and wood and slightly more expensive than materials such as carpet, ceramic, and laminate flooring.

The lower-priced wood products (lower-end solid wood flooring below $4.99/sq.ft) are most affected within the wood category. In contrast, growth in higher-priced wood flooring is relatively stable.

1.3 SPC is the fastest-growing resilient flooring category in terms of sales

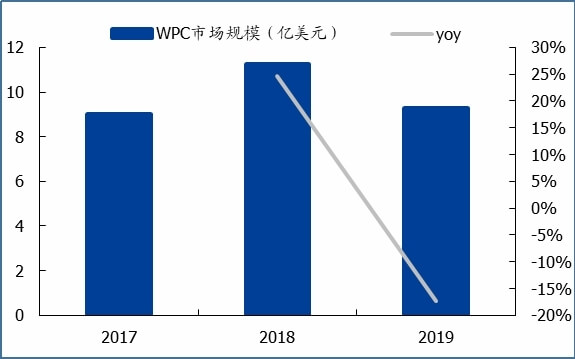

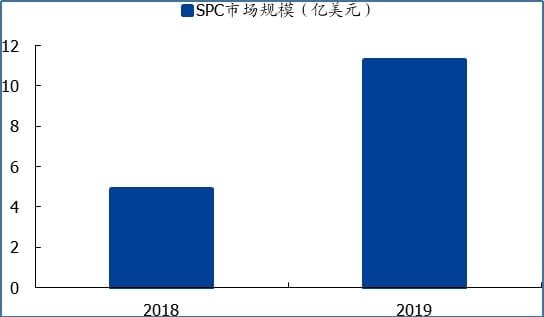

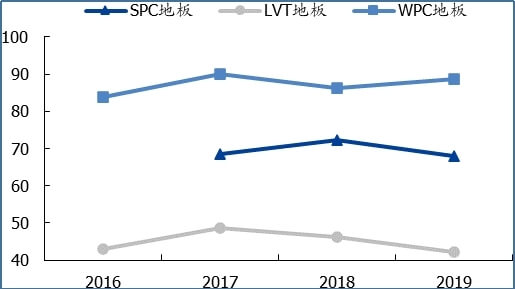

SPC is also growing more rapidly within the luxury vinyl flooring category. According to Floor Covering Weekly, The U.S. market for rigid core LVT flooring (including WPC and SPC) increased by 47.6% in 2019, while sales of regular LVT flooring grew by only 6%. According to Floor Covering News, SPC flooring more than doubled in 2019, while WPC flooring sales and sales declined 15 percent and 17.5 percent, respectively.

There is no significant difference between SPC and WPC flooring in terms of appearance; both can imitate stone, ceramic, wood, carpet, and other textures with the help of digital printing technology.

Since the core layer of SPC flooring consists of limestone, it is denser and more durable than WPC flooring. The high density makes SPC flooring more resistant to scratches and dents than WPC flooring.

WPC flooring contains a foaming agent, which generally provides better footing and sound absorption.

SPC flooring can also provide sound absorption by adding acoustic backing to SPC flooring. In the North American market, consumers are experiencing denting problems after 5-6 years of WPC flooring use. SPC products have the performance of WPC products and can solve the denting problems of WPC products, so they are easy to use.

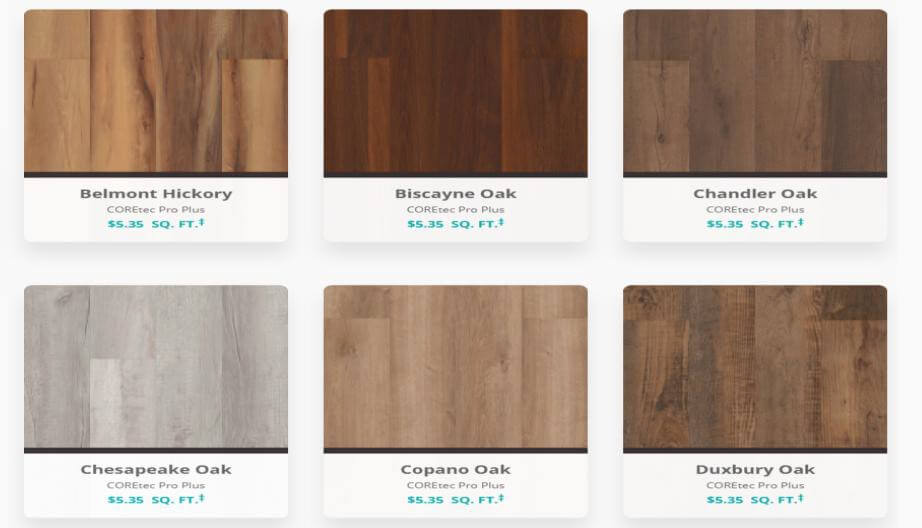

Regarding the end product’s price, the WPC flooring cost is twice that of SPC flooring. For example, Coretec, SHAW’s leading vinyl flooring brand, is $5.35/sq.ft for COREtec Pro Plus (SPC products) and $10/sq.ft for COREtec Plus (WPC products).

The price difference of a single square meter of product is about 50 USD, so SPC flooring has a higher cost performance.

1.4. No worries about demand sustainability; market space is still available.

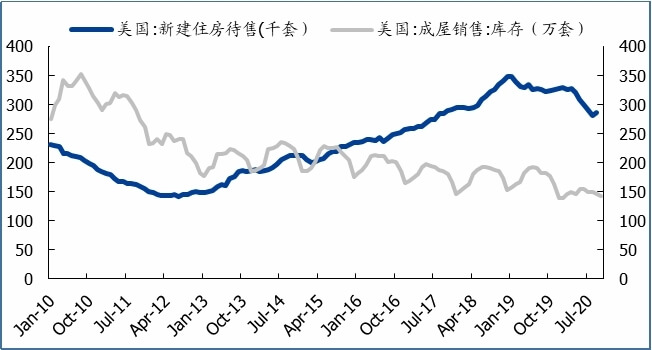

1.4.1 Short-term: High real estate boom + historically low mortgage rates, demand boom is expected to be maintained

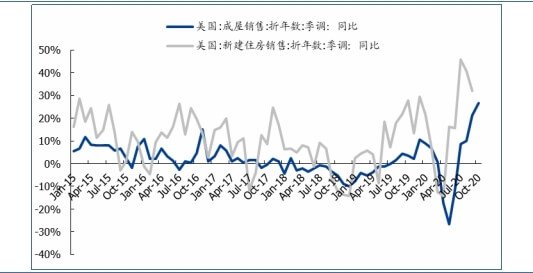

After the epidemic, U.S. housing and new home sales increased significantly year-on-year. Firstly, economic activity is gradually recovering due to the restrictions caused by the epidemic. On the other hand, the epidemic is generating increased demand for better living conditions.

U.S. real estate boom continues to rise, supporting demand for floor coverings. U.S. real estate sentiment (NAHB Real Estate Index) climbed to 90 in November, at a historic high. For new housing construction, the NAHB Real Estate Index is usually ahead of new construction data, and floor coverings are the last process before new homes are listed; for the sales of completed homes, floor coverings sales usually lag behind the delivery of homes by 6-12 months, from the housing market boom, the high boom in real estate is expected to support the demand for floor coverings.

Coupled with the current inventory of completed and new homes are still low, and considering that mortgage rates are still at historic lows, home construction and home transaction activity will increase further in the coming period.

1.4.2 Medium and long-term: the main population of U.S. housing demand to maintain high growth to support the future demand for flooring materials

According to the forecast data from OECD, the growth rate of the U.S. home-buying age group is expected to remain high in the next 8-10 years. The upward trend of the real estate boom is also expected to be maintained.

2. What is the market situation of floor decoration products in the United States?

From the point of view of the U.S. flooring materials industry chain, including multiple participants from brands to distributors to retailers to end customers. The U.S. flooring market share of brand owners is more concentrated, distributors and retailers are more numerous, and multi-category, multi-brand operation. The end sales channels include independent stores, large home centers, chain hard surface decoration specialty stores, contractors, online, direct sales, and other channels.

2.1 the U.S. floor decoration market in the brand/manufacturer share is more concentrated

The U.S. floor decoration market mainly comprises brand owners/manufacturers, distributors, and retailers. Regarding brand names, the manufacturer share of floor covering materials in the U.S. is more concentrated. According to Floor Focus, SHAW, and MOHAWK are the first and second largest floor-covering materials companies in the U.S., occupying 25.2% and 23.8% of the market share, respectively.

Most major floor coverings companies, such as SHAW and MOHAWK, operate under multiple brands, depending on the product category and the markets they cover. These floor-covering manufacturers sell through various channels, including large distributors, home center retailers, online floor-covering retailers, and contractors. The larger manufacturers typically have an extensive distribution system connecting them to large distributors, large home improvement chains, specialty contractors, or retailers, bypassing traditional distributors.

Shaw sells resilient flooring products under its Shaw Floors and Coretec brands.

Shaw’s resilient flooring sales revenue reached $1.795 billion in 2019, up 21% year-over-year.

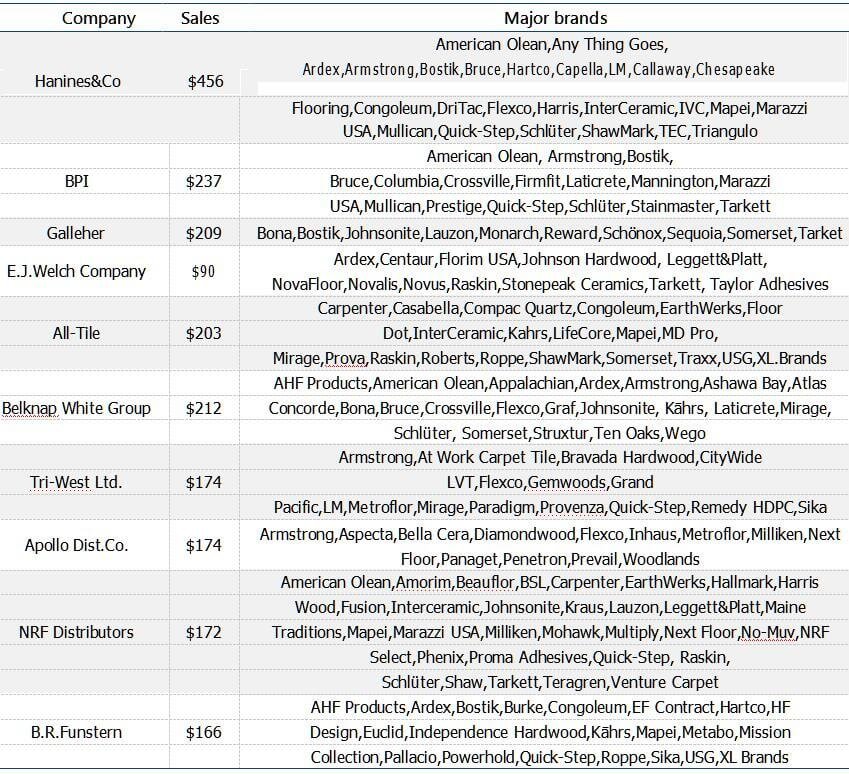

2.2 Large distributors adopt multi-brand and multi-category operation mode

Looking at the marketing model of large distributors, major distributors deal with multiple categories and brands. For example, Hamnis, a large distributor of flooring materials in the U.S., operates brands such as American Olean and Marazzi under MOHAWK, ShawMark under SHAW, and products produced by large brand names such as Armstrong and Bruce.

Some distributors find their suppliers and operate under their brands. MSI, a large distributor, sources products globally and imports more than 50,000 cabinets of products and hundreds of millions of square feet of floor coverings each year, including LVT, tile, stone, and other products.

MSI operates under its brands, including Everlife™ branded LVT and Arterra™ branded tile.

2.3 More decentralized and diversified retail sales system

In the U.S. sales channels of flooring materials, the decentralized flooring independent stores account for 45%, chain building materials and home stores account for 15.6% (Home Depot 9.6%, Lloyd’s 5.1%), professional hard surface decoration stores account for 8.2%, online and direct sales channels account for 4%, and sales through engineering contractors account for 23.2%.

Chain building materials and home stores (Home Depot, Lowe’s, etc.): In 2019, Home Depot had 1,984 stores in the U.S., and Lowe’s had 1,780 stores. 2019 Home Depot and Lowe’s have a market share of 9.6% and 5.1% of the U.S. floor covering the market. 2019 Home Depot and Lowe’s have a flooring materials share of their respective businesses of 6.8% and 5.4 percent.

These family center chains are usually characterized by limited space for product display and a dense product array, with a general display space of 300-500 square meters for floor coverings, 500-600 SKUs for sales, and relatively low product price points, with products mainly positioned at the low end.

Professional flooring decoration stores: professional floor decoration stores represented by Floor&Décor, Lumber liquidators, THE TILE SHOP, etc. usually have larger store areas and can provide more product categories, providing consumers with more professional guidance and after-sales service. In terms of the sourcing model, companies such as Floor&Décor purchase directly from manufacturers, bypassing distribution channels, and are therefore able to offer more competitive prices. The combined market share of professional flooring decoration stores reached 8.2% in 2019.

Specialty hard surface finishing stores have a large and fragmented supplier base. According to the company’s annual report, Floor&Décor sources merchandise from 225 domestic and foreign suppliers, with 35% importing from China, the largest supplier accounting for 15%, and no other supplier accounting for more than 7%; Lumber liquidators importing 46% of their products from China, 6% from Europe and Australia, and 5% from South America; THE TILE SHOP sources 6,000 items from 200 suppliers at home and abroad, with 36% from Europe, 32% from North America, 23% from Asia, and 9% from South America.

Floor Covering Independent Stores: According to Floor Covering Weekly, there were 12,500 floor-covering retail stores in the U.S. market in 2019.

Due to the extreme fragmentation of floor-covering retailers in the U.S., many retail companies have a single-store model, with a total of 9,100 floor-covering retail companies in the U.S. in 2019. Due to their small size, retailers with independent stores mostly purchase products through distributor channels.

Regarding stores, retailers have more flexibility in choosing products and brands to sell. Both independent stores or home centers like Home Depot cover a wide range of flooring products, including carpet, solid wood flooring, resilient flooring, tile, and other categories. Regarding brand selection, large building material center chains such as Home Depot work with relatively few fixed brands.

At the same time, independent retail stores typically operate with multiple brands. According to FCW’s survey, individual retailers display products from 8-10 resilient flooring (LVT) manufacturers/brand names in their stores.

Smaller retailers are the most aggressive sellers of SPC products. Major manufacturers/brand names such as Shaw/Coretec, HMTX, and Mannington focus on the premium end of the market with WPC products. Despite the rapid growth of SPC products, the U.S. market is still dominated by WPC, which is dominated by two giants, Shaw and HMTX.

3. The penetration of vinyl flooring in the European floor decoration market is also accelerating

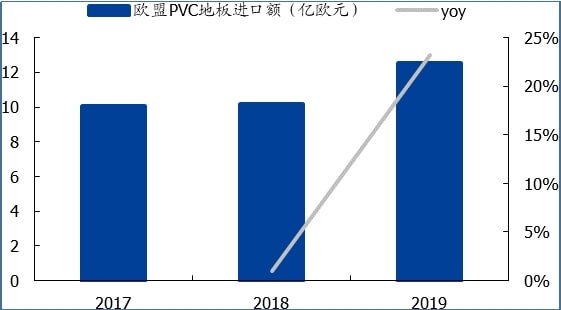

The European vinyl flooring market space (import value) is nearly RMB 10 billion, and the penetration rate tends to increase. In the European market, the proportion of imported flooring decoration materials increased from 15.16% in 2011 to 28.53% in 2018. 2019 EU imports for vinyl flooring reached 1.252 billion euros, an increase of 23.22% year-on-year.

The European market is more stable than the U.S. market, and the revenue of major European importers is growing steadily. From the sub-regional sales of SUNTONE FLOORING, the demand in Europe is also growing faster. The sales of SUNTONE FLOORING outside the U.S. from 2017 to 2019 increased by 88%, 80%, and 17% year-on-year, respectively. The SPC flooring sales growth rate in the European market remains high.

4. SPC flooring rapid growth in industry demand

4.1 The U.S. market is more dependent on Chinese imports of vinyl flooring

Although the U.S. flooring materials manufacturers/brands have a high market share, they still rely more on overseas suppliers. Major manufacturers/brands have a lot of production capacity from regions outside the United States, mainly from China. According to Floor Covering News, the cost of producing resilient flooring in the U.S. is 15% higher than sourcing from China (without considering tariffs). According to Floor Covering Weekly, the share of imports in total U.S. resilient flooring sales (by square footage) reached 82.7% in 2019, up from 71.6% in 2017, with higher import penetration in LVT flooring imports’ share of total U.S. resilient flooring sales (by value) was 76% in 2019.

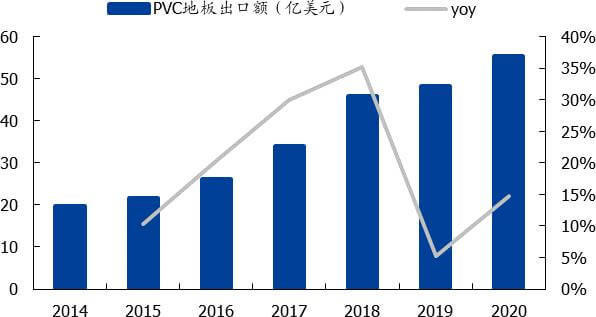

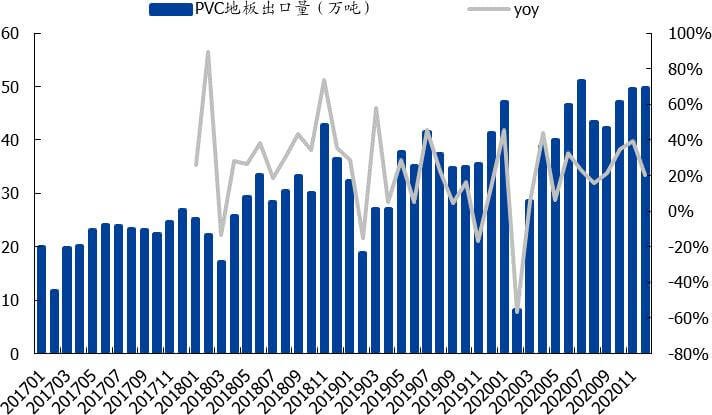

Overseas demand for vinyl flooring is booming, with China’s exports growing at a CAGR of 28.15% from 2013-2018, reaching $3.345 billion in 2019. Due to the impact of trade friction between China and the U.S., the growth rate of U.S. vinyl flooring imports in 2019 has slowed down.

Year-on-year growth of 2.42%. According to U.S. Census Bureau statistics, from 2015 to 2019, China’s exports of vinyl flooring to the United States increased from $845 million to $2.852 billion in sales, accounting for its total imports from 66% to 85%. The U.S. reliance on China’s vinyl flooring supply is increasing.

China’s vinyl flooring exports expanded to $5.6 billion in January-December 2020, up 14.75% year-on-year.

In terms of new categories, there is a greater reliance on overseas suppliers. According to Floor Focus, there are hundreds of manufacturers of rigid core products in China and a few in Asian countries and regions such as Vietnam, South Korea, the Philippines, and Taiwan.

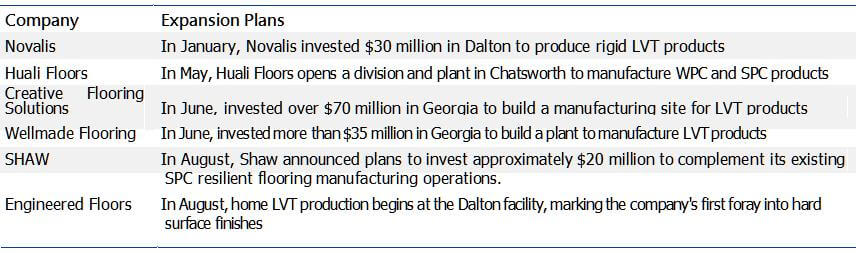

About six U.S. companies are starting to mass-produce SPC products or build capacity for related products, including major companies such as SHAW, Mannington, and Mohawk.

4.2 Vinyl flooring importers with multiple overseas suppliers enjoy advantages

Due to the frequent changes in relevant trade policies and the regular occurrence of trade frictions between China and the U.S., import products face greater uncertainty in tariff policies. In September 2018, the United States imposed a 10% tariff on goods, including vinyl flooring products in China; in May 2019, the tariff was adjusted to 25%; in October 2019, the tariff was adjusted to 30%; In November 2019, tariffs are excluded for some products from several industries, including vinyl flooring; in August 2020, tariffs are reinstated at 25% for products such as vinyl flooring.

Product prices have partially decreased due to trade friction. From the time point of tariff increase, mainly between October 2018 and October 2019.

According to SUNTONE FLOORING, the company’s sales price decreased by approximately 6.56% due to two tariff rate adjustments. The company, customers, and end-users share the increase in tariff, and the company’s share is in the range of 2%-8%.

Although the tariff increase caused by trade friction is shared between manufacturing plants and their downstream customers, most of the tariff increase is passed on to end-consumers.

The increase in product prices may lead to a decrease in sales. As a result, most manufacturers/brands are looking for suppliers globally and are not dependent on a single supplier. Part of the consequence of higher tariffs due to trade frictions is that there will be a shift in product orders, with brands looking for lower-priced sources of products.

5. How do view the recent shipping costs, exchange rates, and raw material price fluctuations impact on SPC Flooring business?

Recently, the profitability of vinyl flooring import chain enterprises has been affected to a certain extent due to the continuous appreciation of the RMB, the rise in the price of PVC raw materials, and the elevated impact of shipping costs. Still, nevertheless, the number and amount of vinyl flooring imports are relatively unaffected.

Considering that the demand for vinyl flooring is strong and the main supply comes from China, we believe the demand side is relatively rigid. The need for import orders will not be affected much by this.

The supply side of shipping capacity is seriously inadequate, and the shipping cost has increased significantly. Despite the significant increase in export containers and shipping costs, the export volume of vinyl flooring was not greatly affected in China, with the export volume of vinyl flooring increasing by 35%, 40%, and 20% from October to December 2020, respectively.

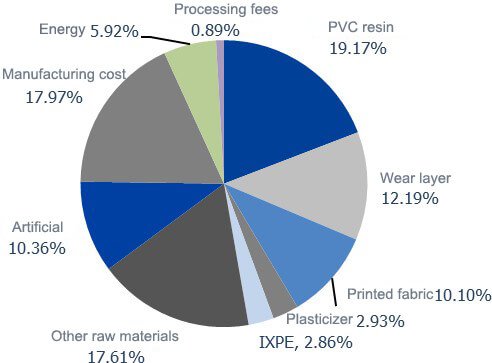

PVC resin is the primary raw material of resilient flooring. In addition to the base material used in the PVC resin powder, outsourcing of wear-resistant layer, etc., also involves using PVC resin. The overall PVC accounts for about 1/3 of the cost.

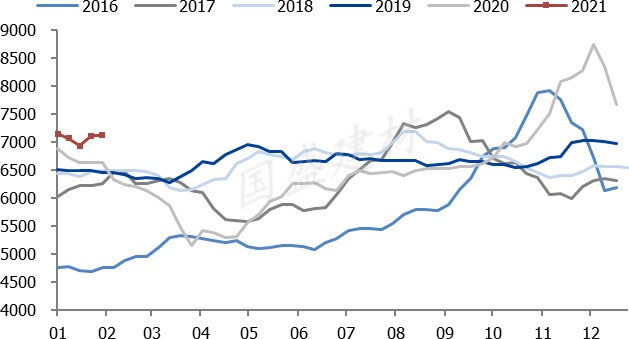

Since April 2020, the average price of PVC resin has continued to rise, from the lowest level in April to the highest level in December, an increase of up to 70%, resulting in the cost of vinyl flooring manufacturers’ short-term pressure. Since late December, the price of PVC resin has gradually fallen back to 7,100 yuan/ton. The short-term pressure caused by the fluctuation of raw material prices is expected to ease gradually.

As a result of exchange rate fluctuations, the weakening of the U.S. dollar against the Chinese yuan, the increase in raw material prices, and the increase in transportation costs due to the lack of shipping and capacity, the major resilient flooring operators in the U.S. increased their average product prices, with Armstrong and Mohawk increasing their prices by 9% and 8%, respectively.

Overall, as vinyl flooring production capacity is mainly concentrated in China and overseas demand is solid, there is less risk of shifting orders to other countries or regions in the short term. With the recovery of shipping capacity and vinyl prices, these short-term effects are expected to disappear. We remain optimistic about the future high boom in demand for the SPC flooring business.

SUNTONE is a vinyl flooring manufacturer that specializes in providing high-quality vinyl flooring to businesses and projects worldwide. Our factory has advanced SPC/LVT production lines and an advanced laboratory to ensure the quality of our products. We are committed to providing the best materials and have become a designated OEM supplier for many famous brands abroad, exporting worldwide!